blog

Commercial Property Research – Office Property 4th Quarter 2021

Commercial Property Research - Office Property 4th Quarter 2021

Overview

In Q4 2021, Singapore’s economy continued to grow strongly amid improving global and trade outlook. Based on advance GDP estimates, the Singapore economy grew strongly by 5.9% YOY and 2.6% QOQ in Q4 2021. Based on these estimates, the economy has grown by 7.2% for the full year, according to the Ministry of Trade and Industry (MTI). The economy is projected to grow by 3% to 5% in 2022.

The office property market ended the year on a strong note with several big-ticket deals inked during the quarter. Market observations suggest that demand for office space is expected to remain buoyant with a number of businesses looking to expand against a backdrop of the global economic recovery and limited availability of prime office space.

Rentals are expected to grow at a faster pace in 2022, which could further pique the interest of investors in Singapore's prime office assets and drive capital value. The economic expansion along with Singapore’s commitment towards the reopening of its economy and its borders, will boost the office market’s investment and occupier demand in 2022.

Sales Transactions and Prices

- According to the URA office price index, the prices of office space contracted by 1.8% QOQ in Q4 2021, continuing the downward trend from the 2.4% contraction in Q3 2021 – the slip in prices was largely attributed to the Central Area office prices which contracted by 2.7% QOQ. For the whole year, office prices have contracted by 5.8%.

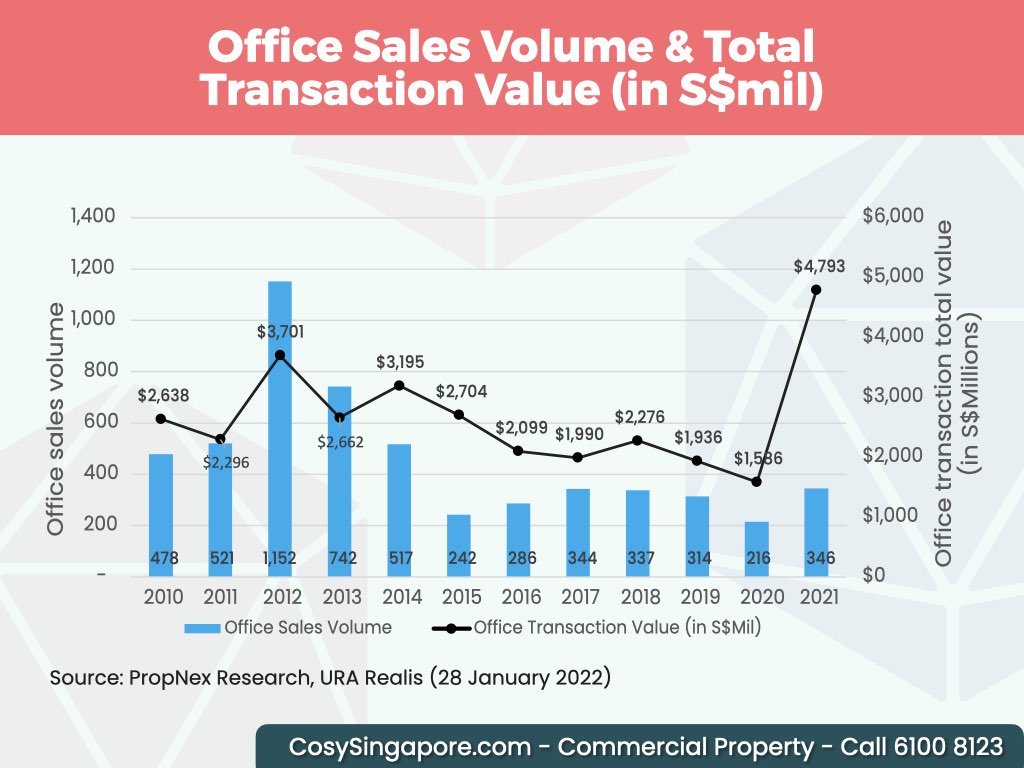

- Based on caveats lodged, the total value of transactions in Q4 2021 surged to $2.03 billion, up sharply from $241.9 million in Q3 2021. This took 2021 sales to $4.79 billion, which does not capture deals for which caveats were not lodged. The total value of deals transacted in 2021 has surpassed the last peak in 2012, where values hit $3.7 billion.

- In Q4 2021, there were 98 sales transactions, reflecting a 30.6% QOQ increase from the 75 deals done in Q3 2021. For the whole year, there were 346 office sales – the highest since 2014.

- The highlight of Q4’s office transactions was the divestment of the 23-storey Grade A office building on One George Street by OGS LLP – a limited liability partnership, of which CapitaLand Commercial Trust (CCT) owned 50 per cent of – to SG OGS, a private firm, in mid-November for $1.28 billion. Just a month later, the building was then acquired from SG OGS by a joint venture between JPMorgan Global Alternatives and Nuveen Real Estate for $1.29 billion. A caveat has yet to be lodged for the second deal, and should it be included – it brings the total value of office investment deals in Q4 to more than $3.3 billion.

- Based on caveats, the next biggest office deal of Q4 was the sale of 112 Robinson, a 14-storey freehold commercial building on 112 Robinson Road for $269.7 million. The purchase price works out to $2,925 per square foot based on a net lettable area (NLA) of 92,205 sq ft. The buyer is Alpha Eins (SG) Pte Ltd, an entity of Munich-based family office AM Alpha. The 112 Robinson deal is believed to be the family office’s first direct real estate acquisition in Singapore.

Rentals and Leasing Trends

- Despite activities in the year-end being typically slower, due to the seasonal lull, the leasing market in Q4 2021 fared relatively well compared to the same period in the last couple of years.

- The URA office rental index showed that rents inched up by 0.9% in Q4 2021, reversing from the 3.5% decline in Q3 2021. For the whole of 2021, office rentals have grown by 1.9%

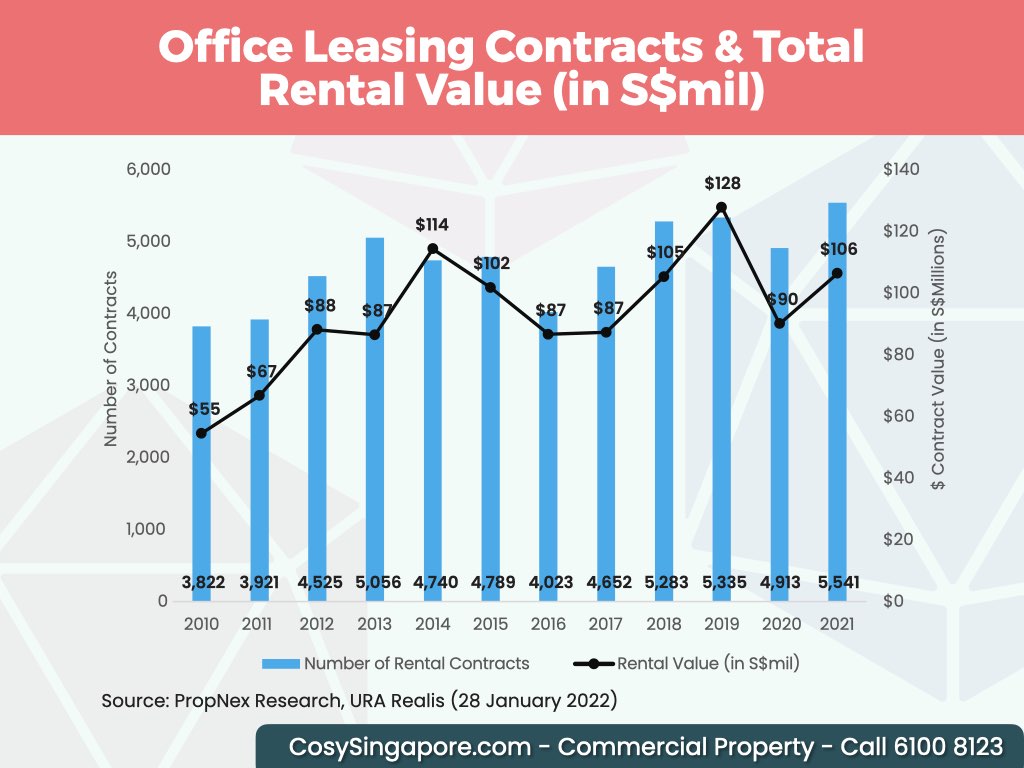

- According to Realis data, the number of office rental transactions rose by 6.2% QOQ to 1,385 contracts in Q4 2021. On a YOY basis, the number of rental contracts was up by 7.9%.

- Total rental value contracted slightly by 0.7% QOQ to $27.0 million in Q4 2021. However, on a YOY basis, overall leasing value grew by 26.6% from $21.3 million in Q4 2020.

- 2021 was the year of “flight-to-quality” where a number of occupiers seized the chance to relocate to a better location or space with better specifications. Many occupiers also conducted space-rationalisation reviews in view of more workers telecommuting.• Rentals have recovered strongly on the back of the economic recovery and Singapore’s steady roll out of the vaccination programme – both of which has helped to boost the confidence among businesses and office occupiers. Delays in office supply completions due to construction disruptions has kept office supply fairly tight and rentals firm.

- For 2022, demand for office space will likely be primarily led by tech and finance institutions as well as corporates that are increasing headcounts for business expansion, as the global economy return to normalcy. As of January 2022, 50% of the workforce are allowed to return to their workplace, bring more buzz to the office districts.

- Some leasing trends that may gain traction in 2022 include co-working, offices that allow flexible space configurations as well as offices with green features and high-quality air filtration systems.

Office Vacancies

- Latest URA data showed that the island-wide vacancy rate of office space has decreased slightly. Vacancies dipped to 12.8% as of Q4 2021 from 12.9% in the previous quarter.

- Vacant Private Sector Office Space island-wide declined to 952,000 sqm (nett) as at Q4 2021, down from 967,000 sqm in Q3 2021. The bulk of vacant space in Q4 was located in the Downtown Core at 533,000 sq m.

- According to the URA, the amount of occupied office space fell by 10,000 sqm (nett) in Q4 2021, following the decrease of 5,000 sqm (nett) in Q3 2021. Meanwhile, the stock of office space decreased by 23,000 sqm (nett) in Q4 2021.

- In terms of supply in the pipeline, there was a total of 786,000 sqm gross floor area (GFA) of supply as at end of Q4 2021, compared with the 755,000 sqm GFA of space in Q3 2021.

- In 2022, the limited incoming office supply – estimated at 78,000 sqm - should help to support occupancies in the near-term. At the same time, there may be an uptick in leasing demand from occupiers that have been displaced from buildings that are slated for redevelopment, such as AXA Tower and Fuji Xerox Towers.

Market Outlook

Looking ahead, office prices and rentals are expected to continue to recover in 2022, in light of limited Grade A new office supply and the positive economic outlook.

While the prospects in the office property market are generally looking up, there are some downside risks including the impending interest rate hikes and rising inflation, potential emergence of new virus variants, supply chain disruptions as well as China’s economic slowdown.

Growth in the office market may also be uneven, with investors and occupiers being more selective; prime office assets that have higher specifications and located in choice locations may be more sought after, compared to Grade B office spaces or buildings outside the downtown core.

Have a Chat With Us

CosySingapore Consultants

Commercial Properties Singapore

8.00 am to 10.00 pm

Hotline: +65 6100 8123

Email: CosySingapore@gmail.com

Scan this code for Whatsapp

Urban Development Authority (URA) Definition of Shop and Restaurant

Urban Development Authority (URA) Definition of Shop and Restaurant

|

S/No |

Use |

Definition | Examples |

|

1 |

Shop |

“shop” –

(a) Define as premises used for any trade or business where its primary purpose is the sale of goods or foodstuffs by retail or the provision of services (b) Includes furniture shop, departmental store, pawnshop, dispensary, medical clinic, dental clinic*, beauty salon, ticket agency, travel agency, confectionery or take-away food-shops that retails food or drinks for consumption away from the premise and does not provide for the consumption of food or drinks on premise. This may include an ancillary food preparation area. (c) Does not include (i) Preparation of food for sale by distribution or catering even though the food is consumed away from the premises; (ii) Storage or wholesale of goods or foodstuffs; (iii) Sale of coffins, sale of motor vehicle parts and accessories. (iv) Repair and servicing of motor vehicles. (v) Petrol station, laundry shop, dry cleaner’s shop, funfair, market, nightclub, bar, pet shop, showroom, motor vehicle showroom, amusement centre, health centre, being outlet or an office. (vi) Any part of an industrial retail building or a warehouse retail building used for business zone retail; and * Conversion of shop units to medical clinic/dental clinic on an en-bloc basis (e.g. change of use involving the entire floor(s) or substantial part of a floor or the building) is subjected to prior planning permission and clearance from relevant agencies (e.g. LTA, NEA, MOH). |

Retail shops:

Departmental store, Supermarket, Provision shop, Minimart, Fashion boutiques, Florist, Gift shop, Electrical appliances / equipment, Computer & Accessories, Chinese medical hall, Furniture shop, Home furnishings & Textile shop, Stationary, Aquarium, Shops selling takeaway food and drinks/ beverages with no consumption on the premises. Services: Barber Shop, Beauty Salon, Hairdressing Salon, Photo Studio, Tailor Shop, Foot Reflexology, Chinese Physician/ Acupuncturist, Medical Clinic, Dental Clinic Receiving Agency Launderette (collection of goods to be washed/cleaned elsewhere), Money Changer and Travel/Ticket Agency. *Take-away food-shops: Shops selling curry puffs, rice dumpling, pastries, buns, bubble tea and ice-cream, barbecue meat etc. purely for takeaway and without tables and chairs for dining at the premises. Light and simple ancillary food preparation such as baking, microwaving and steaming of food may be allowed in a take-away food-shop. The operator has to comply with NEA’s licensing conditions and ensure that the activities do not cause fumes, smell or other nuisances. |

|

2 |

Restaurant |

“restaurant” –

(a) Premises that are primarily used for the sale of foodstuff for consumption at the premises without performance of live music or live entertainment. (b) Includes a coffee shop, eating house, snack bar, cafeteria or foodcourt, fast-food restaurant, tea house. (c) Does not include a canteen, bar or pub.

|

Fast-food Restaurant, Foodcourt, Coffee Shop, Ea1ng-House, Snack-bar, Teahouse, Cafeteria |

Have a Chat With Us

CosySingapore Consultants

Commercial Properties Singapore

8.00 am to 10.00 pm

Hotline: +65 6100 8123

Email: CosySingapore@gmail.com

Scan this code for Whatsapp

Industrial Market Segment Outlook 2020 Singapore

Industrial Market Segment Singapore - Outlook 2020

Have a Chat With Us

CosySingapore Consultants

Commercial Properties Singapore

8.00 am to 10.00 pm

Hotline: +65 6100 8123

Email: CosySingapore@gmail.com

Scan this code for Whatsapp

Health City Novena

Health City Novena

Singapore’s Biggest Healthcare Complex by 2030

Master Plan

The master plan for HealthCity Novena was officially launched in 2013, embracing the development of a healthcare hub which will cater to the future healthcare needs of our population, while integrating with the community at Novena.

Focusing on Care, Continuous Learning and Innovation, Community, and Connectivity, it has collaborations with the following seven institutions to integrate care, education, learning and living in the central region of Singapore.

- Tan Tock Seng Hospital

- National Skin Centre

- Dover Park Hospice

- Ren Ci Hospital

- National Neuroscience Institute

- National Healthcare Group and its latest partner

- Lee Kong Chian School of Medicine – to integrate care, education, learning and living in the central region of Singapore.

HealthCity Novena is described as Singapore’s largest medical complex with 15 integrated buildings including 9 new developments. boasting 8 hectares of greenery, fitness and heritage for the community and a comprehensive network of aerial bridges, basements and street linkages to facilitate safe and convenient access across HealthCity.

The total number of beds for acute care will go up by 12 per cent, and the number for intermediate step-down care, by 60 per cent. This means that the number of step-down beds in Health City will go up from four to six for every 10 acute beds.

Smart City

The use of robotics in healthcare at Tan Tock Seng Hospital uses to automate their pharmacy operations in the picking and packing of medications and tracking of expiry dates has helped to improve safety and waiting time. They are also looking to develop an intelligent IT system to connect its emergency department, wards and housekeeping to manage its 1,500 beds across different locations.

Another example is Tele-health - leading to innovative ways of delivering healthcare faster, cheaper and better. For example, tele-rehabilitation allows stroke patients to perform rehabilitative exercises or physiotherapy in the comfort of their own homes, leveraging the convenience of communication technology.

Connectivity

Patient’s medical records can be accessed wherever he is, part of the integration of institutions’ collaboration. This will help them to perform complementary functions are sited together to optimise care and are interlinked for safe, convenient and good access to care.

The healthcare hub will channel more resources to ambulatory and intermediate care – including rehabilitation, sub-acute care and palliative care – as such services facilitate the transition of patients back to the community.

Have a Chat With Us

CosySingapore Consultants

Commercial Properties Singapore

8.00 am to 10.00 pm

Hotline: +65 6100 8123

Email: CosySingapore@gmail.com

Scan this code for Whatsapp

Industry Property Singapore Infographics

Types of Industrial Properties Singapore

Most of the industrial properties in Singapore are being hosted by JTC and there are not many strata industrial properties.

There are 3 zones of industrial property types:

Business 1 – Building used for industry, warehouse, utilities and telecommunication uses where the nuisance buffer is 50 m or less

Business 2 – Building used for industry, warehouse, utilities and telecommunication uses where the nuisance buffer is more than 50 m but still within health and safety buffers.

Business Park – Buildings are used for non-pollutive industries that engage in high technology, research and development, high value-added and knowledge intensive activities.

With limited strata industrial properties available for sale, many companies took the opportunity to own them for their own use and investors have their own strategies to obtain such properties.

For users, there is high chance that it may more sense to own an industrial property versus having to rent one. There are still some good strata industrial properties available for sale from the developers.

Below is an infographics on Industry Property of Singapore:

Have a Chat With Us

CosySingapore Consultants

Commercial Properties Singapore

8.00 am to 10.00 pm

Hotline: +65 6100 8123

Email: CosySingapore@gmail.com

Scan this code for Whatsapp

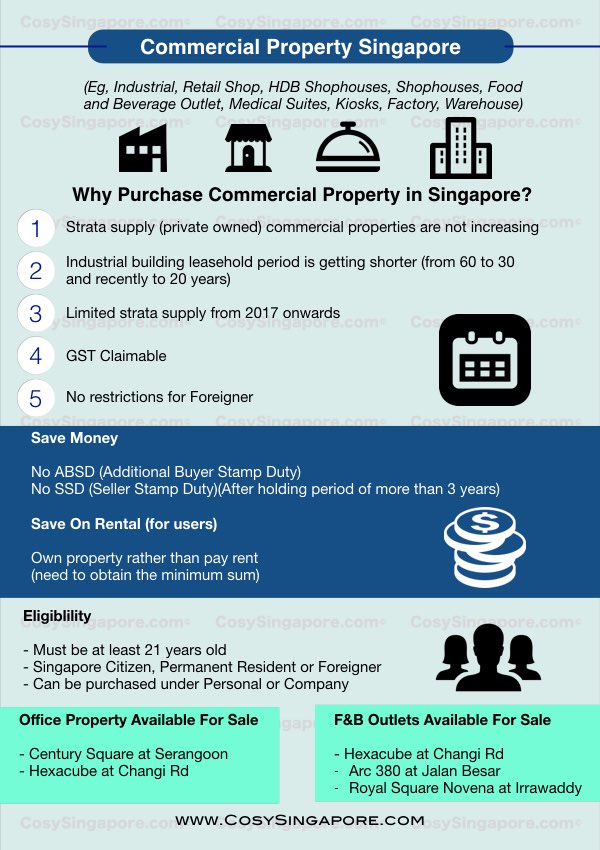

Commercial Property Singapore Infographics

Commercial Property Market Singapore Infographics

Class 1: Shop

Class 2: Office

Class 3: Restaurant

Class 4: Amusement Centre

Class 5: Motor Vehicle Showroom

Class 6: Theatre

Class 7: Light Industrial Building

Class 8: General Industrial Building

Class 9: Special Industrial Building

Class 10: Warehouse

Class 11: Convalescent Home

Class 12: Child Care Centre

Class 13: Community Building

Class 14: Sports and Recreation Building

Class 15: Nightclub

Class 16: Pet Shop

Class 17: Community Sports and Fitness Building

Class 18: Commercial School

Within industrial properties, there are 3 zones of industrial property types, which are Business 1, Business 2 that are dependent on the nuisance buffer, and then there is Business Park for non-pollute industries.

Of late, the commercial property is getting interesting with low rate of sales and difficult rental. Many companies are taking advantage of this and went in search for a better place to rent. Commercial property unlike residential property is not as flexible. A company would need to house their employees in a commercial property.

Some companies opt to rent because their management is unable to decide on getting an asset and some foreign companies are not able to determine how long they will stay in Singapore. For local companies, it would make more sense to own a commercial property rather than to rent it if they have sufficient money and aims to operate for a long time.

Appended below is an infographics on Commercial Property for Singapore.

Buying a commercial property with a Corporate entity

What are the benefits of buying a commercial property with a Corporate entity?

No Capital Gains Tax in Singapore

Generally, the gains derived from the sale of a property in Singapore is not taxable as it is considered a capital gain and the country has no capital gains tax. The exception to the rule is when a person is deemed to be trading in properties. This is determined based on the following:

- frequency of transactions (buying and selling of properties)

- reasons for acquiring and selling of property

- financial means to hold the property for long term

- holding period

Lower Corporate Tax Rates

Personal tax rates are higher than corporate tax rates in Singapore especially for high income brackets. Hence it is always better to hold commercial property under a corporate entity.

More Tax Relief

Moreover, under personal tax laws, indirect expenses that can be claimed are limited. A corporate entity can claim much more direct and indirect expenses, which helps in getting higher tax exemptions.

Cheaper Cost of Funds

In addition, a corporate entity buying a commercial property is advantageous if you want to finance your purchase externally. This is so because personal borrowing interest rates are normally higher than corporate borrowing rates.

Easy Transfer of Ownership

A Special Purpose Vehicle for holding commercial properties has more flexibility while transferring ownership, as compared to when an individual owner sells a commercial property.

Singapore Property Holding Companies Get Tax Exemptions and Rebates

Partial Tax Exemption

While the new company may not be eligible for the Start-up Tax Exemption (SUTE) scheme, it still will enjoy partial tax exemptions given to companies since 2008 on normal chargeable income of up to S$300,000.

- for first S$10,000, after 75 percent exemption, the exempt amount is S$7,500

- for next S$290,000, after 50 perfect exemption, the exempt amount is S$145,000

- thus, the total exempt amount for income up to S$300,000 is S$152,500

| Chargeable income | Exemption | Exempt income |

| First S$10,000 | 75% | S$7,500 |

| Next S$290,000 | 50% | S$145,000 |

| So up to S$300,000 | S$152,500 |

* Since 2010, SUTE has been extended to include companies by guarantee. However, the tax exemption scheme for new start-up companies is not extended to investment holding companies and companies engaged in property development activities that are incorporated after February, 2013.

Corporate Tax Rebate

In 2013, the government announced that for year of assessment 2013, 2014 and 2015, all companies will be granted a 30 percent corporate income tax rebate that is subject to an annual cap of S$30,000. The newly-incorporated company to buy commercial property can enjoy this if the property is let out for rental income.

Goods & Services Tax (GST)

While sale and lease of residential properties are exempted from GST in Singapore, transaction of commercial (non-residential) real estate is not.

| Residential Properties | Non-Residential Properties |

|

|

An individual buying commercial property will have to absorb 7 percent GST in addition to the valuation price for the property.

Instead, if a company is buying a commercial property, it can consider getting GST registered, which is a very streamlined and easy process. This way the company can claim back the GST amount paid.

Please note that IRAS put forth many requirements before allowing GST- registered companies to claim back the GST already paid. So it’s always better to check with the Authority on your eligibility, or appoint us to register for GST.

Buying from not-GST-registered seller

A factor to consider while buying a commercial property is whether the seller is GST-registered. This so because a S$100,000 property, when bought from a GST registered company, would cost an additional S$7,000 to the buyer.

If the seller is not GST-registered, the buyer can save these S$7,000.

Separate legal entity

Because a private limited company is treated as a separate legal entity, the company shareholders have limited liability and are safeguarded against personal financial ruin even if the commercial property investment fails to generate much revenues.

Thus, in case of a corporate entity liabilities are limited to the share capital of an individual in the company. Whereas if you buy commercial property in your own name, your liabilities will extend to all your other assets.

Stamp Duty Costs

Stamp duty is a tax on documents relating to immovable properties, stocks or shares. Examples of such documents are lease/tenancy agreements, mortgages, and share transfer documents.

While there is no Additional Buyer Stamp Duty (ABSD) for commercial properties, industrial properties (a type of commercial properties) attracts the Seller’s Stamp Duty. This is 15% of the sale price if sold on the first year, 10% for the second year, and 5% for the third year.

Individuals form a company and then the company buys a commercial property

But the real advantage in stamp duties is when a group of individuals buy a commercial property after incorporating a company together. The property is bought in the company’s name and the individuals hold shares in the company in the same proportions as they would otherwise hold as co-owners of the property.

If any shareholder wishes to sell his shares in the company either to his co-shareholders or to a third party, they can do so. With this, his or her portion in the commercial property is also sold indirectly.

The benefit in this is that the stamp fees of 0.2 percent payable on the value of the shares of the company sold is much lower than the ad valorem stamp fees of almost 3 percent payable in respect of the value of the share in the property.

Carry Forward losses as a Singapore private limited company

Carrying business loss and capital allowances forward

In current uncertain times, you can never be sure. A private limited company which bought commercial property to benefit from rental income, may suffer some downturns in the rental income.

Such companies are allowed to carry forward the unabsorbed trade (rental) losses and capital allowances to subsequent years to offset against the income of those years until the trade losses are fully utilised.

Though very few and insignificant, the disadvantages of buying a commercial property under a newly-incorporated private limited company in Singapore are:

Administrative burden

But do note that the compliance requirements of a private limited company are much more as it is always governed by the laws, rules and regulations under the Singapore Companies Act, which are much stricter.

Property Tax

There is a flat rate of 10 percent for property tax on non-residential properties, which must be taken into account while doing the rental yield calculations.

Property Loan

Individual owners also get fairly good preferential property loan interest rates, which are not available to private limited companies.

CPF

Individual owners can use their CPF savings to buy commercial properties for investment purposes. But it cannot be used for any contribution towards the shareholding of a company or the repayment of any loan taken by the company to finance the purchase of the property.

Have a Chat With Us

CosySingapore Consultants

Commercial Properties Singapore

8.00 am to 10.00 pm

Hotline: +65 6100 8123

Email: CosySingapore@gmail.com

Scan this code for Whatsapp

What is Office Space in Singapore?

Role of URA Singapore

The Urban Redevelopment Authority (URA) serves as Singapore's planning authority, guided by the mission to transform Singapore into an exceptional city for residence, work, and recreation. In pursuit of this mission, URA meticulously plans and facilitates the physical development of Singapore, aspiring to build a vibrant, sustainable, and globally distinctive city. The planning decisions and guidelines implemented by URA carry lasting implications for the value of properties.

This development process involves URA harmonizing various, sometimes competing, needs to ensure a physical environment of high quality and appeal. The agency employs a framework of meticulous development coordination, proactive planning, and adaptable development controls that are attuned to business requirements. The outcome is an exemplary urban environment that is both conducive and responsive to the diverse activities and demands of a 21st-century global city.

URA engages in the formulation of long-term strategic plans and detailed local area plans for physical development. Subsequently, it coordinates and guides efforts to actualize these plans. The strategic and careful planning of land use has been instrumental in fostering robust economic growth, social cohesion, and ensuring that adequate land is reserved to sustain ongoing economic advancement and future development. As defined by URA, offices are establishments used for conducting business and administrative activities.

Some examples are Class II Office or Commercial School, such as:

- Bank

- Finance office, insurance company, stock exchange.

- Real estate housing agency.

- Contractors, transport office.

- Professional, consultant, architect, engineer, lawyer, accountant, advertising agency, research and marketing office.

- Employment agency, secretarial services.

- Astrologers/palmists.

- Security office.

- Political party office.

Commercial School: Premises used for the purpose of teaching, training or imparting of knowledge or skill. Some examples are:

- Tuition centre

- Language school

- Computer school

- Dress-making school

- Baking and cooking school

- Music school

- Dance school

- Acting school

- Speech and drama school

- Child development centre, or play school

- Art school.

Locations where a new office can be considered for approval:

- Shopping centres, commercial buildings, hotels and shophouses.

- Check Land Use Zoning in the Master Plan 2019.

Locations where a new office is unlikely to be approved:

- Non-commercial premises (e.g. residential premises, industrial premises).

- Units located along pedestrian routes or facing public roads at the first and basement levels of commercial developments (e.g. shopping centre, commercial buildings and hotels) in activity generating areas.

- Check Activity Generating Uses Plan in the Master Plan 2019.

The concept of "Office Spaced Defined by Authority" refers to the official definition and categorization of office spaces by the Urban Redevelopment Authority (URA) in Singapore. The URA has established a specific definition for office spaces and excludes shops from this category. This distinction is important for regulatory and planning purposes.

In Singapore, there are generally four categories of commercial office properties based on the URA's classification:

- Standard Office Buildings: Standard office buildings are typical commercial buildings that offer various amenities such as security, lifts, central air-conditioning, and sometimes individual air conditioning units within each office unit. The maintenance of common areas is usually handled by the building landlord or the Management Corporation Strata Title (MCST) for strata-titled offices. These buildings often come equipped with essential features like ceiling boards, lighting systems, and fire safety systems.

- Serviced Offices & Co-Working Spaces: Serviced offices and co-working spaces are fully equipped office environments where tenants can start working almost immediately. These spaces are usually located in the Central Business District (CBD), city fringe areas, or commercial hubs. They are particularly attractive to small businesses, start-ups, or overseas companies looking for a representative office. Serviced offices and co-working spaces can accommodate varying numbers of people, from a single individual to around 100 occupants.

- Shophouses: Shophouses are a distinct type of office space that appeals to companies seeking a creative and less formal environment. They are often favored by architecture firms, advertising agencies, interior design companies, and similar creative industries. Shophouses are typically low-rise buildings, often conserved for their historical or architectural significance. One advantage of shophouses is that their rental rates are usually lower compared to other office types, as they generally do not have service charges or maintenance fees. Most shophouse units are offered in a bare condition, allowing tenants to customize the space according to their needs.

- Business Parks: Business parks encompass a range of office spaces, some of which resemble standard office buildings, while others offer specialized features. Business parks cater to industries and businesses involved in non-pollutive, high-tech, high value-added, knowledge-intensive, and research and development activities. Some business park spaces may include features like floor traps and exhaust systems to accommodate specific industry requirements.

These different categories of office spaces provide businesses with diverse options to choose from based on their specific needs, preferences, and operational requirements. The URA's definition and categorization help provide clarity and guidance to businesses and property developers, as well as aid in urban planning and development efforts.

Have a Chat With Us

CosySingapore Consultants

Commercial Properties Singapore

8.00 am to 10.00 pm

Hotline: +65 6100 8123

Email: CosySingapore@gmail.com

Scan this code for Whatsapp